Powell stated that the FOMC had decided to raise the benchmark rate by 25% and noted that "ongoing increases...will appropriate strong>

Federal Reserve raises benchmark bank rate

The Federal Reserve has announced for the first time since the Covid-19 pandemic. It raised the benchmark interest rate from close to zero to 0.255% to achieve its target of 0.25% or 0.50%.

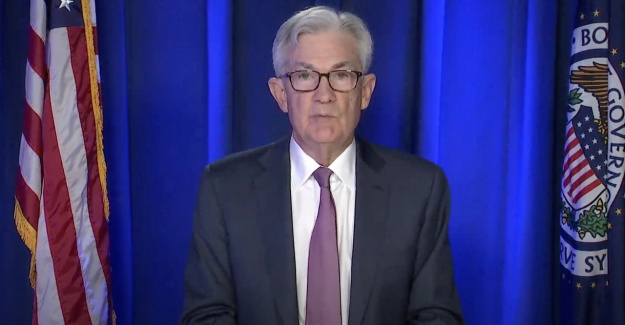

Jerome Powell, Fed chair, announced the rate increase on Wednesday. He mentioned the ongoing Russia-Ukraine conflict and stressed that the "implications for the U.S. economic are highly uncertain."

Powell explained quickly that Powell had mentioned that the U.S. economic, and in particular the jobs sector, was showing strength. He also highlighted that the FOMC had raised the benchmark rate by 25% and that there would be "ongoing increases..."

Powell also spoke out in favor of reducing the Fed's purchase program, but noted that more details would be revealed at a later meeting. The benchmark bank rate was last raised by the Fed in December 2018, well before the Covid-19 pandemic.

In its post-meeting statements, the Fed discussed the possibility of reducing the balance sheet of the U.S. central banks at the next FOMC meeting. The post-meeting statement details that the committee "expects to reduce its holdings in Treasury securities, agency debt, and agency mortgage-backed security at a forthcoming meeting."

The FOMC expects six additional rate increases at every FOMC meeting, in addition to the quarter-percent increase. The central bank expects to raise rates three more times next year.

"The committee is determined take the necessary steps to restore price stability. Jerome Powell, Fed chair, stated that the U.S. economy was strong and well-positioned for tighter monetary policies during his press conference statements.

Federal Reserve: US Inflation remains Elevated

Peter Schiff, an economist and gold bug, tweeted about the Fed's rate hike. Schiff stated that the only reason why the Fed raised rates was inflation. The Fed didn't plan any rate increases in 2022 before admitting that inflation was not temporary. The Fed has no other options than to keep rates at zero, given current geopolitical risks as well as weakness in the economy or financial markets.

In fact, the U.S. central banking admitted that inflation remained high in post-meeting statements. The FOMC rate hike announcement explained that inflation remains high, reflecting supply-demand imbalances due to the pandemic, higher oil prices and wider price pressures.

The popular U.S. indexes, including the Dow Jones Industrial Average, NYSE and S&P 500, remained green following the FOMC rate increase announcement. After a short jump in the early trading hours on Wednesday (ET), crypto economy markets remained stable.

Following the FOMC statements, the crypto economy has risen 1.2% over the past 24 hours. The price for one ounce of.999 pure gold has fallen by 0.17% in the past 24 hours. One ounce of gold trades for $1,914 an ounce at press time. This is 7.08% lower than the asset's most recent high of $2,060.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets A Commission created by the CSD will supervise the RFEF

A Commission created by the CSD will supervise the RFEF The AN judge prosecutes the former ETA leader for her responsibility in the kidnapping and murder of Miguel Ángel Blanco

The AN judge prosecutes the former ETA leader for her responsibility in the kidnapping and murder of Miguel Ángel Blanco The European Parliament condemns the contacts of the Catalan independence movement with Russia and demands an investigation

The European Parliament condemns the contacts of the Catalan independence movement with Russia and demands an investigation The PSC would win the Catalan elections with 39-40 seats, Junts would obtain 28-30 and ERC 27-28, according to the CIS

The PSC would win the Catalan elections with 39-40 seats, Junts would obtain 28-30 and ERC 27-28, according to the CIS How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Retrópolis brings the golden age of video games and computing to the UPV

Retrópolis brings the golden age of video games and computing to the UPV Looking for video games that value the neighborhoods of Valencia

Looking for video games that value the neighborhoods of Valencia UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump

UPV researchers improve the efficiency of air conditioning systems using a geothermal heat pump València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean"

València is committed to citiverse and smart tourism to be "the reference technological hub of the Mediterranean" A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness