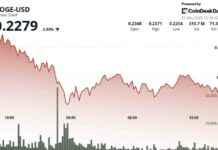

The recent security breach at WazirX, an Indian cryptocurrency exchange, has resulted in significant losses for users. The exploit, linked to North Korea, saw $230 million worth of user assets stolen, with the majority of the funds now converted to ether (ETH) totaling $200 million. This has had a major impact on WazirX’s liquidity and listed token prices, with the exchange’s WRX token experiencing a 40% drop in value in the past 24 hours.

Hackers often convert stolen tokens to ether in order to utilize mixing services like Tornado Cash, which help to conceal transactional activity and facilitate money laundering. As a result of the exploit, tokens listed on WazirX are now trading at significant discounts compared to their global and local prices, indicating poor liquidity and high selling pressure.

The bitcoin/rupee and shiba inu/rupee trading pairs on WazirX have experienced drops of 22% and 30% respectively in the past 24 hours. In contrast, other local exchanges such as CoinDCX and Zebpay have only seen a 2% decrease in prices. WazirX’s own WRX token has plummeted by 40% within the same timeframe, while trading volumes on the exchange have surged to $8 million in the past 24 hours, up from $2.2 million just two days prior.

Following the security breach, WazirX has temporarily suspended crypto and fiat withdrawals. The exchange attributes the exploit to a “mismatch” between a digital interface and a major crypto wallet, despite the presence of five signers from the exchange on the wallet storing user assets. This explanation has been met with skepticism from some members of the Indian crypto community, who question the security measures and compliance standards of exchanges in the country.

The stolen funds, which accounted for over 45% of WazirX’s total reserves as reported in June 2024, have left users uncertain about the possibility of recovery. The incident has raised concerns about the overall state of cryptocurrency security in India and has prompted calls for greater transparency and accountability within the industry.

As WazirX works to address the aftermath of the security breach and restore user confidence, the broader crypto community will be closely monitoring the situation to ensure that necessary safeguards are put in place to prevent similar incidents in the future.