Employees, independent... what will be the impact of the reform on future pensions ? Here are four concrete examples from major lines that are already known.

A euro contributed to give the same rights for all. It is the goal hammered by the high commissioner to the pension reform and the new minister Jean-Paul Delevoye : the new pension system that he has proposed to the government is more just and more equitable.

Is this true ? Maybe. But, for there to be winners there must be losers. "The new rules of the game will not be favourable to everyone," warns Dominique Prévert, of Optimaretraite. This is illustrated by the simulations he has carried out and which we publish below : in the identical situation, they compare the rights of a future pensioner in the current situation (left) to those for which it may claim in the future plan to points.

READ ALSO >> Pensions : reform fair ?

Your support is essential. Subscribe for $ 1 support UsEverything can still change. A new phase of negotiations begins with the social partners and there is still some way to go before the recommendations of the report Delevoye become bill. However, it is possible to make projections - albeit theoretical - based on the assumptions made on 18 July :

• the expected performance of The new item announced is 5.5%. In other words : for 100 euros together, a retiree will receive a 5.5 euros per year for the whole of her pension - the rate final will not be defined only in 2024. This is the one that we selected for the calculations.

• For pension contributions, a single rate from 28,12% will be applied to wages from January 2025. But on these 28,12%, only 25,31% will be eligible for points - figure chosen for the calculations. 28,12 least 25,31 : the 2,81% remaining will participate in the financing of the system.

• For the self-employed, contributions will be 28,12% up to one times the annual Ceiling of the social security (Pass), equal to 40 524€ in 2019, but 12,94% 1 to 3-Pass - or, always in 2019, which is between 40 524€ and 121 572€.

Practice >> Compare the best deals of health mutuals senior in partnership with DevisProx

To illustrate, in the table below, the current system, the examples are based on an average of pay throughout a career. In the basic plan, to get the famous "full rate", an employee born from 1973 will have to justify 172 quarters.

Example # 1. Julie, a non-framework with a child earned an average of 30,000 euros per year throughout his career and will be the number of quarters sufficient to receive a pension monthly gross 1751 euros. In the future point system, it would be to 1496 euros. The annual contribution wage will decrease to 18 euros.

.

Optimaretraite

Example # 2. Gabrielle earned an average of € 18,000 per year over his professional life, but does not have the number of quarters sufficient (100 instead of 172). It would affect 522 euros with the system by points, compared to 463 euros in the current system. Its annual contribution salary would be € 11.

.

Optimaretraite

Example # 3. Mahmoud, a framework, has gained an average of 60 000 euros gross per year. If it's going to be 62 years with all its quarters (172), he shall receive a pension of a little more than 2992 euros in the future system by points, against 3259 euros in the current system. The annual contribution wage increased from 97€.

.

Optimaretraite3

Example # 4. Paul, a doctor of sector 1, was exercised in a liberal and collected 120 000 euros per year on average. If he leaves at the full rate, he will see his pension cut in the future plan: it is expected to fall to 3608 euros compared to 4500 euros today. The annual fee would be in addition superior 1967 €

.

Optimaretraite

Read our complete file

pension Reform Macron

The pension reform could be "set aside", according to Gilles, The Son-in-law Retreats : after the 49-3 at the Meeting, the battle for the Senate is preparing to Pensions : the macronistes reject the commission of inquiry desired by the socialistsIn these examples, the calculations have been made to limit social security, value and duration of assessment constant. The children have not been taken into account. Women and men will be able to benefit from an additional 5% of the points from the first child. Today, only the parents of at least three children to receive a bonus of 10 %.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

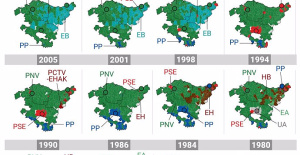

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness