once upon A time, was established in the savings banks, in order to help out the little people in this country have to save and get some sort of return, and trading volume. Many of the the thing small-were on the other side of the base for the cheaper loans for the farmers and the entrepreneurs, who were able to invest more, is a vital part of Sweden, which is helped by the abolition skråväsende, and the freedom to conduct a business in the 1800-century in the last decades, leaving the poverty and degradation behind it, and in a hundred years, has become one of the world's richest countries.

It says something about our times when the end result of this småfolkets sparbanksrörelse, today, Swedbank, in an effort to clean out the little people in the name of the bank. Managing director Jens Henriksson, has recently launched the strategy described in the näringslivssidor (SvD 28/1).

”Those who have reached the age of sufficient customer data to the individual compounds, which do not have annual reports, and so on, the most we are going to freeze your account, too. At the end of the day, we have to make sure that they need us as a customer.”

and Swedbank, been fat omsättningsbonusar in their special care of the rich oligarchs and their skumraskpartner, and that he has chosen to ignore the elemental signs. In this way, they are likely to be contributed to the fight against money laundering. This is a problem, the bank is now addressed through the stricter application of the acquis in the compounds, and to the small investors.

our customers are already monitored it as it is. Anyone who has tried to take the cash to the bank branch to know that they are not interested in the money that way. The normal customers have found it difficult to know in advance of paying off their loans. When the banks make on the legal framework on money laundering has already hardened.

When the banks are profiting from the legal framework to combat money laundering are already hardened.

One of these is around the customers is called the Henry Bronett, the ringmaster, and for my generation, for ever, the poet Daniel is in the ”Store”. He recently wrote a frustrated blog post (25/1), if the details of the red tape that is required at the contact of the bank in managing the money. Why would a father want to have a debit card for their teenage son, which had become necessary as the shops and cafes don't take cash anymore – certify that it is a political security risk?

in Both is that everyone who is not working goes. So, why is it that the bank with this strategy. It puts the blame on the authorities, and it is true, for sure. The authorities don't either, they found that the money laundering in the Baltic countries, would like to be able to have your back, and it's usually to stop the completion of the formal protocol.

But the sad fact is that it probably is a good deal for the bank.

At the time of the zero - and minusräntor, the banks ' money is cheap, more and more often via foreign loans, and turned lucrative through the home. Småkundernas accounts sparslantar, and the meagre pensions and wages in such an environment the most, as an administrative expense, as their cash. They want the banks enough time to dispose of it;

this is yet another example of how the räntemiljön to zero, and minusräntor widen the economic divide. This is not just a new record in property and share prices, but are also on the other side, have their price in terms of lower bankbetjäning, and with the weakening of the higher rates of travel, imported food and fuel.

in the long Term, has to be the interest rates to be restored to reasonable levels, so that even the ordinary wage-earner is viable, and to welcome the customers of the banks, which provide the necessary payment infrastructure. However, in order to at the very least do not worsen the situation, the Swedish financial supervisory authority to be transparent vis-à-vis banks in terms of the regulatory framework and how it is applied.

for Example, with the following message: ”Look, you are sure that you have the order of the item that is moving millions in an inexplicable way. Leaving, however, the old lady Used alone, even though she has not reached the age set out in the annual protocol and stated that she was not a resident of the Bahamas. And bövelen with the skills to take the cash from the sybehörsföreningens such as the christmas bazaar at the Knäckebröhult.”

Stand up for the little people in the name of which was once the småfolkets the bank does not have the knowledge to do this yourself. Do not allow Swedbank to hide behind the laws of anti-money laundering.

<

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

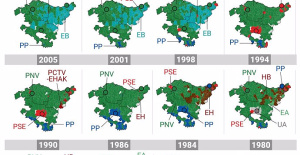

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness