MADRID, 11 Sep. (EUROPA PRESS) -

The new temporary taxes on the extraordinary profits of the large energy companies and financial entities promoted by the Government face their first examination this Tuesday in the Plenary Session of Congress, which must decide on the admission to processing of the bill registered by the PSOE and United We Can.

The new taxes were announced by the President of the Government, Pedro Sánchez, during his speech at the Debate on the State of the Nation as part of the economic plan to deal with the costs derived from the energy and price crisis, derived from the Russian invasion of Ukraine.

Days later, PSOE and United We Can registered the initiative, in which they propose a temporary tax of 4.8% on the interest margin and net commissions of financial entities with revenues of more than 800 million euros, and 1.2 % of total sales of energy companies that invoice more than 1,000 million euros per year.

The new tax on the energy sector will be in force during 2023 and 2024 and will seek to collect 2,000 million euros a year from the extraordinary profits of these companies in 2022 and 2023.

On its side, the "exceptional and temporary" tax aimed at "the large financial entities that have already begun to benefit from the rise in interest rates", as the Government has argued, will last for two years -on the exercises 2022 and 2023-- and will seek to raise 1.5 billion each year.

On the possibility that companies transfer the cost of the tax to customers, the Government has established in the proposal a penalty of 150% of the amount that is transferred to the user.

The National Markets and Competition Commission (CNMC) would be the body in charge of ensuring that the tax is not passed on to customers in the case of energy companies; for banks, the CNMC must collaborate with the Bank of Spain.

With regard to the electricity, gas and oil sector, the benefit is set at 1.2% of its turnover, which makes it possible for the contributions of each group to respond to its market share.

On the other hand, the general rule is that economic groups that hold the status of main operators, defined in accordance with tax regulations, are subject to the provision, which exclusively includes the Spanish companies of the group, not being subject to tax, therefore, the turnover obtained by these groups through subsidiaries in other countries.

In the case of credit institutions, the benefit is set at 4.8% of their interest margin --interest collected less paid-- plus their net commissions --collected less paid. According to the proposal, these are items that allow maintaining "due proportionality" in the contributions of each business group according to their market share.

As is the case with energy companies, tax groups are subject to the benefit as a general rule, leaving out the interest and commissions obtained by their subsidiaries in the sector.

"In the credit institution sector, it is important to know the weight that the levy implies with respect to its main magnitudes. Thus, the estimated annual impact of the levy barely represents 0.06% of the value of the assets of large credit institutions Spanish", maintain PSOE and United We Can in the proposal.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

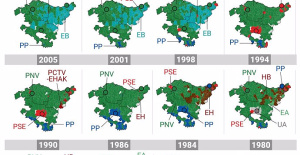

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness