MADRID, 2 Ago. (EUROPA PRESS) -

The six listed banks --BBVA, Sabadell, CaixaBank, Santander, Unicaja Banco and Bankinter-- continued to reduce their branch network in Spain in the first half of the year, with a 9% cut compared to December, as well as their staff , 4.7% less, according to the data published in the semi-annual reports and compiled by Europa Press.

At the end of June, the branch network was made up of 10,765 offices and the workforce totaled 119,425 employees in Spain. Between the end of March and the end of June, the number of branches fell by 3.9% and the teams of the six banks fell by 1.0%.

These data have moderated compared to other quarters, when the falls were in double digits, impacted by the employment regulation files (ERE) that the banks launched before the arrival of the Covid-19 pandemic, the acceleration of digitization and consolidation of the sector.

Specifically, in 2021, two major banking mergers were carried out, on the one hand, the integration of Bankia into CaixaBank and, on the other, that of Liberbank into Unicaja Banco, so that the entities resulting from the process decided to reduce their staff and the number of branches in order to avoid having oversized equipment and networks.

Regarding EREs, Banco Santander executed an adjustment in 2021 that affected 3,572 employees, as well as the closure of 1,033 branches, while BBVA signed an ERE in June 2021 for 2,935 employees and 480 branches.

Sabadell, which has executed the bulk of the ERE in the first part of 2022, agreed to leave a maximum of 1,605 employees and the closure of 320 branches, plus the conversion of around 170 branches into advanced savings banks, while the CaixaBank ERE It has affected a total of 6,452 workers and involves the closure of 1,534 branches.

Finally, Unicaja has not yet completed the adjustment, although it had already executed at the end of June about 56% of the agreed ERE and that affects 1,513 employees. It also implies the closure of some 400 branches.

In this way, the large Spanish banks would have already faced the great adjustment in the number of branches and workers, which will allow it to reduce costs, gain efficiency and increase profitability.

According to the latest figures published by the Bank of Spain, at the end of March the bank branch network had dropped to 18,556 branches, compared to the 21,900 recorded at the end of March 2021. These data include all credit institutions in the country .

However, this process of restructuring the network and the staff of the entities has not been without controversy: in January of this year, the retiree Carlos San Juan launched a campaign to collect signatures to ask for a better deal in bank branches, which would give rise to new measures by the sector to respond to the needs of groups such as the elderly or people with disabilities.

Likewise, the need for rural areas not to be excluded from banking services has also been stressed. The result of the banks' efforts to improve the financial inclusion of these areas is a recent study by the employers' associations AEB, CECA and Unacc that estimated around 657,000 people who did not have any type of banking service in their municipality.

For its part, the Bank of Spain published a report last week stating that 11.2% of the Spanish rural population, equivalent to 705,733 people, do not have access to any type of face-to-face banking service and 23.3% (1.4 million people) reside in municipalities without a bank branch.

With the aim of alleviating this situation and facilitating access to banking services in towns without banking services, without losing efficiency, the entities have agreed to an alliance with Correos that will make Correos Cash available to the sector: this service will allow withdrawals and cash receipts at 4,675 service points (including more than 2,300 offices and 2,282 other rural services) and through 6,000 rural postmen at home. Each banking entity may seal bilateral agreements with Correos.

By entities, CaixaBank is the entity with the most offices in Spain: 4,206 at the end of June, a figure that has decreased by 15.3% compared to December, and 6.2% compared to March. It is also the one with the most employees, up to 40,561, according to data from the semi-annual report, 10.4% less compared to the end of 2021 and 3.4% less compared to March.

Banco Santander currently has a workforce of 26,270 employees, around 1% more than in December and 0.7% more than in March. As for its branch network, it is made up of 1,921 facilities, 1.5% less than in March and than in December 2021, when it had 1,950 branches.

The BBVA workforce in Spain is close to 25,000 employees, after increasing by 0.6% compared to December, while it has 1,886 branches, 0.4% less.

For its part, Banco Sabadell closed the first half with 12,949 workers, 6.5% less than the figure for December, of 13,855 employees. Its branch network has remained practically stable at 1,290 branches.

Unicaja Banco, which is the only one of the large banks that is still executing the exits contemplated in the ERE, is the entity that registers the greatest setbacks both in its branch network and in the number of employees: the number of its workers had reduced by 10% at the end of June compared to the figure for December, to 8,337, and the number of branches, almost 20%, to stand at 1,097.

Finally, Bankinter has kept its offices in Spain at 365 and has increased its workforce by 2.8%, to 6,311 employees, although the latter is a figure for the entire group, including its businesses abroad.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

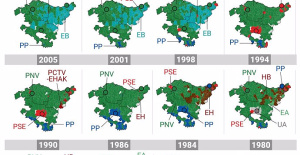

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness