Defends financial entities with a "light and flexible" structure and a "personal treatment" to the client

MADRID, 8 Jul. (EUROPA PRESS) -

The president of the 'la Caixa' Banking Foundation and of CECA, Isidro Fainé, has urged "to look to the future with optimism" despite the "complex scenario" that the world is experiencing derived from the pandemic, inflation and the war in Ukraine .

In this sense, he has indicated that the global GDP is below what was expected three years ago, with inflation "much higher" than was imaginable then, with which "the living conditions of the vast majority of citizens have not improved as they should.

However, he referred to the "transforming effects that are already beginning to be felt in the social, economic and financial spheres, such as the acceleration of the digitization process and new consumer habits, the reconfiguration of international financial relations and the redesign of global supply chains, as well as the realization that inflation was not dead and interest rates were not locked in forever.

Fainé made these statements during the closing in Paris of the congress of the World Institute of Savings and Retail Banks (WSBI), which he also chairs and which is made up of more than 7,000 entities in 63 countries on all continents.

During his speech, he opted for these entities to develop "a light and flexible organizational structure" and to distinguish themselves by "personal and exquisite treatment" of any client.

"The treatment must be frank, friendly and humane, whatever the communication channel used," he assured.

He also highlighted that these entities are facing a "decisive phase" in their history in the face of this complex scenario in which "urgent adversities in the short term are combined with significant transformations in the medium and long term".

The 26th WSBI World Congress has approved the Declaration of Paris 2022, a backbone document that advocates promoting sustainable finance to ensure the economic resilience of the communities in which they operate.

The WSBI, created in 1924, represents more than 6,000 savings and retail banks from around the world whose total assets amount to 15.6 trillion dollars and serve nearly 2,000 million clients, offering financial services mainly to SMEs and families.

The approved declaration invites regulators to coordinate and harmonize different taxonomies to promote interoperability and mutual recognition. Such a measure can help promote sustainable cross-border finance, as well as reduce compliance costs, the CECA explained in a statement.

Fainé opened the meeting stating that "feeling and acting in a socially responsible manner is inextricably linked to the identity" of the entities that are part of the organization.

"The fact is that we were born this way, it is part of our DNA, and it is our vocation. All this translates into our way of doing banking, which is fundamentally different from that of other players in the sector and, furthermore, it is profitable, efficient and fair," Fainé said before the more than 200 participants from all continents, who met in person in Paris for the first time since 2018.

The Paris World Congress was held in the French capital on July 7 and 8 under the title 'Rooted in the community. Globally responsible', thus underlining the WSBI 3Rs model -retail, responsible and rooted- as a necessary strategy to build a more inclusive and sustainable society.

Leading experts linked to the financial world and from different jurisdictions discussed the main issues on the current economic and financial agenda: regulatory harmonization in sustainable finance; digitization and its impact on financial inclusion; and the wide scope of social responsibility in the recovery environments and geopolitical changes that currently coexist at the global level.

Among the prominent representatives of the international regulatory field were Mairead McGuinness, Commissioner for Financial Stability, Financial Services and Capital Markets Union of the European Commission, and José Manuel Campa, President of the European Banking Authority.

For her part, the Secretary of State for Digitization and IA of the Government, Carme Artigas, has appeared via video. The director of Financial Studies of FUNCAS, Santiago Carbó, the director of Public Affairs of CaixaBank, Christian Castro, the general director of CECA, José María Méndez, and Shlomo Ben-Ami, vice president of the Toledo International Center for Peace and former Israeli ambassador in Spain have also attended this triennial meeting.

As a parallel event to the World Congress, the presentation of the Scale2Save (S2S) program took place, which, after six years of activity, will come to an end on August 31.

This program, developed by WSBI in alliance with the Mastercard Foundation, has aimed to promote financial inclusion through the establishment of basic savings accounts in developing countries and financial education projects, thus overcoming the barriers faced by most of the population of these countries in access to financial services.

With 1,078,000 registered customers as of March 31 and a monthly activity rate of 20% over the last twelve months, S2S exceeded its numerical commitment to reach one million customers.

Thanks to its total budget of more than 16 million dollars, S2S managed to carry out successful projects in places such as Ivory Coast, Morocco, Nigeria, Kenya, Senegal, Tanzania and Uganda.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

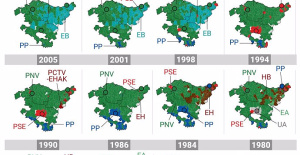

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness