He will take to the Council of Ministers the regulation that develops the law to promote employment plans "in the coming weeks"

MADRID, 26 Sep. (EUROPA PRESS) -

The Minister of Inclusion, Social Security and Migration, José Luis Escrivá, has assured this Monday that the unstopping of the base and the maximum pension "equivalently" and in a "gradual and smooth" period of about 30 years will contribute, along with the overpayment introduced by the Intergenerational Equity Mechanism (MEI), to "fill" the pension system with income in the 2030s and 2040s, the most stressed by the expense that the retirements of the 'baby boomers' will entail.

During his speech at an event organized by the Seres Foundation, Escrivá recalled that the unstopping of the maximum base and the maximum pension is one of the measures to be agreed with the social agents as part of the recommendations of the Toledo Pact and of the commitments assumed by Brussels in the framework of the Spanish Recovery Plan.

The minister has insisted that the maximum pension in Spain is "relatively low" in the contributory system, since it is around 40,000 euros per year.

"Uncovering the maximum base and the maximum pension at the same time, equivalently, and doing it gradually and very smoothly so that it does not have a significant effect on the labor cost of companies, can be done in 30 years, it has the potential that it fills the income in the 30s and 40s (...), although from the point of view of the system, in the very long term, it is neutral because you collect before and then pay larger pensions", he explained.

The minister has pointed out that spending on pensions is around 12% of GDP, somewhat below the European average, and has assured that staying at these levels is "affordable".

"With all this set of measures we want to more or less stabilize that spending. It will have to be readjusted over time, in the coming years and decades. Our starting point is manageable, but the measures must be taken now, with a medium-term vision , and do it gradually to adjust them progressively", he defended.

Escrivá has explained that the tensions in spending forecast for the 2030s and 2040s are due to the retirement of a "very broad" generation, that of the 'baby boomers', which is followed by a "narrower" generation. However, this tension in the spending of the pension system disappears as of 2048 because the generation of the children of the 'baby boomers' is already of a "similar size".

Thus, to face these tensions in expenses, the MEI has been adopted, which establishes an overcontribution of 0.6% until 2032 and which does not imply "a significant change in the labor costs of companies, but it does generate significant savings" for Social Security. And along with this, now it is sought to agree with the social agents the progressive unstopping of the base and the maximum pension.

The minister has reviewed some of the measures that were approved in the first block of the pension reform to guarantee the sustainability of the system, such as the improvement of the system of disincentives for early retirement and the design of better incentives for people to delay your retirement.

"We still have to work a little more on flexible retirement and part-time retirement mechanisms, since there is still room for improvement in the system, but we decided to start with delayed retirement, which is the most general, and then work on other categories," he specified.

The minister, who has urged companies to take advantage of the talent of their 'senior' workers, has recalled that the main risks to the system's sustainability have a structural component (increased life expectancy) and a temporary one (increased spending derived from the retirements of the 'baby boomers').

In the first case, the problem is addressed by bringing the effective retirement age closer to the legal age, which will be 67 years in 2027, which is why many of the measures contained in the pension reform are aimed at that objective.

The last two measures adopted as part of this reform are the introduction of a new contribution system for the self-employed and the law on employment pension plans, whose development regulations, currently in the Council of State, will be approved in the Council of Ministers "in the coming weeks", according to Escrivá.

In another order of things, the minister wanted to send a message to companies, especially those that are benefiting from the current economic situation, alluding to energy companies and financial entities, to which the Government is going to apply an extraordinary tax.

"The business world has to understand that from the public sphere we must transmit certainties to the majority of society (...) We have to understand, among all of us, that what we have to do is protect those who have been most affected by the cost of energy and inflation and that requires redistributive policies. They have to understand that we have to readjust resources so that those with less income have extra protection", he insisted.

In this sense, he stressed that pensioners, who already have their purchasing power guaranteed thanks to the pension reform, also have to face an extra cost due to inflation and energy and require "special protection".

“That is why it is difficult for me to understand the debate on whether pensioners should have their purchasing power guaranteed,” Escrivá declared, adding that this is not debated in other European countries, where the protection of the purchasing power of pensioners is also the norm .

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

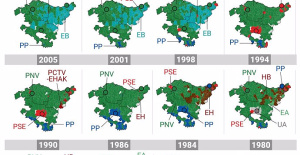

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness