Perform a partial buyout on his contract of life insurance, it is possible. This withdrawal follows a simple procedure, but strict. Here it is not to not.

Check to see the withdrawal conditions of your contract

All life insurance contracts allow for partial redemptions (article L. 132-21 and following of the insurance Code). This term is somewhat jargonnant actually covers a reality that is basic, listed in the regulation : the possibility for each subscriber to retrieve in case of need, at any time, a portion of his savings (provided that the contract has not been accepted by the beneficiary).

According to the insurers, and contracts, the faculty may, however, be lightly framed. For example, it is possible that you may not be able to (for cost of processing each request) make withdrawals of less than 500€ for example... check!

Arbitrez if necessary

If you have only played the security card, do not worry : your withdrawal will be made from the fund euros of your contract and him alone. On the other hand, if you have played the card of diversification, well understood, and if your savings is logically distributed between different units of account and the funds in euros, you should know that your partial redemption will automatically be calculated in proportion to the value of the units of each holder of the investment held.

Your support is essential. Subscribe for $ 1 support UsIf you do not want it to be so, you must either specify to the insurer (and provide, in this case from which support the partial redemption takes place), or the prior one or several trade-offs.

Practice >> check out the investment REITS in partnership with CORUM's SAVINGS

Comply with the formalities required

To make your redemption request, there are two modes of operation. The first, more classical, is to send a registered letter to your insurance company, with a copy of your identity card, a bank identity statement and the last statement of annual information of your contract (sent at least once per year).

PRACTICE >>> The form letter to request a partial redemption of your life insurance contract

The latter document is very easy to download on your personal space online. The second, the more current is to make your redemption request online. This possibility is not only less formal, but more importantly, fast, in terms of timing of disbursement of funds (see below).

Answer the questions

No withdrawals without "back-up" of the insurer... it's the law! This one should indeed check what use you intend to make the sum that you want to recover : need for cash, real estate purchase, repayment of a loan... either in an agency (if you have purchased your contract from a bank-insurer), with a broker or on the Internet, you must not escape it!

Calculate the taxable interest

To optimize fiscally speaking your partial withdrawal, you have two options : ask your insurer tells you the share of interest included in such withdrawal or calculate it yourself. This operation is less difficult than it seems.

The insurers apply the following formula : amount of the partial redemption - ((total payments made to the date of the purchase x amount of a partial redemption)/value of total redemption of the contract at the date of the redemption).

Example : you have invested 100 000 euros on a contract there are more than 8 years and you want now to withdraw 30000€, while the value of total redemption of your contract is eur 130 000. To obtain the share of earnings included in the withdrawal of 30000€, it is necessary to perform the following calculation : 30 000 - (100 000 x 30 000/130 000), which gives 6923€.

If you are single, the tax will be on the 2323€ in excess of the allowance of 4600€ : so you have a 174€ tax to pay if you choose the standard deduction (PFL) (7,5% x 2323€). And if you are married or pacsé, you will not have to pay because the allowance of 9200€ is not crossed!

Choose the right option tax

Other formality, and not the least : the choice of the tax applicable to the portion of interest included in your partial withdrawal. Here, the winnings can either be included in your taxable income (which is the default choice of the insurer), be subject to a PFL. It is 35% if you purchased your contract there are less than 4 years and 15 % if you open it more than 4 years but less than 8 years.

This PFL goes to 7.5 % after 8 years, but the most interesting thing is not there : the gains benefit from an allowance in the annual 4600 € for a single person and 9,200 euros for a couple subject to joint tax. Before any operation of purchase, so you should refer to your notice of assessment from the past year, without forgetting to anticipate the level of your income in the current year, to get to know your marginal tax rate and make the right decision regarding your partial redemption.

Pull a part of some life events

There are certain situations provided for by the regulation and for which you may qualify for a total exemption of tax on the share of earnings included in your redemptions. This possibilité is worth whatever the anteriority of your contract (more or less 8 years old), if you or your spouse (in a fiscal sense, that is to say, married or pacsé) are in one of the following cases : dismissal, early retirement, disability (category 2 or 3), cessation of activity following a judgment of judicial liquidation. This tax exemption applies only if the withdrawal is made before the end of the year following the year of the event.

Do not worry beyond measure...

If your contract has more than 8 years, if you make a "small" withdrawal (4000€ for example) and if you opt for the PFL of 7.5%, do not think that there has been a "bank error" in your disadvantage if the amount that you see on your statement of personal bank account is lower than you hoped... In fact, and it is tax regulation, which requires, the insurer will directly deduct the 7.5 % on the winnings of your first withdrawal (as well as the social levies at the rate of 15.5 %), without a care in the world of the abatement which you can benefit...because, where applicable, this allowance will be returned to you later, by the tax administration, in the form of a tax credit.

Amazing, this is no less logical : the insurer has no way of knowing whether or not you have performed one or several other partial withdrawals on one or more other contracts of life insurance during the same year, and thus, whether or not you have crossed the threshold of the abatement applicable to your situation!

Optimize abatement annual

If your contract over 8 years and if you want to puncture a large sum of money (50000€, for example), consider optimizing your withdrawal, that is to say, to benefit two times instead of one time of the abatement annual to which you are entitled. To do this, simply make your request in two stages : once at the end of the current calendar year and a second time at the beginning of the following year... In the worst case, if the interest crosses every time the abatement annual, you will have anyway decreased your tax invoice.

Check the delay of payment

Each insurer has two months to carry out your request for a partial redemption. If it is hanging out this operation, the regulations provide, in addition to the requested capital, a payment equal to the legal interest rate in force (to 4.16 % for 2017), plus one-half for the first two months of delay, and then plus 100 % thereafter.

Read our complete file

life Insurance : what are the best contracts ? What is yours ?

Investment : is it to be tempted by the funding formula ? Life insurance: the collection has grown in 2019, with nearly 26 billion euros in life Insurance : how to earn moreFor a partial withdrawal of 10000€ for example, you must as well perceive 10016,60€ if the operation is actually performed more than 70 days after the date of receipt of your registered letter and 10166,56€ if it takes place 150 days after.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

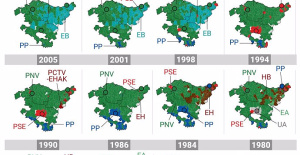

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness