To live yours american dream, except to have a heritage, a result, you will have to make some concessions. Administrative burdens, housing conditions, labour, tax etc... : here's everything you need to know before you moved to New York.

Live and work in New York, it is the dream of many French, whether they are traders, pastry chefs, engineers or designers. But, to get there, it is the path of the fighter. You must first become a permanent resident, thus receiving the Green Card, the famous green card. To do this, a u.s. employer must be a guarantor . It is often easier to obtain visas to residents of limited duration in time. This is the case of visas, E1 and E2 issued for five years to those who want to invest in the United States, the H1-B visa for six years, for highly skilled jobs, or even a visa O, reserved creative.

Brussels, Lisbon... Discover 5 other destinations where you install need to work or take your retirement.

real estate out of reach

once you have your visa and a job, you will need to stay. The prices are prohibitive. Unless you are sure to remain in New York, it is better to rent. Don't dream-not of the beautiful areas of Manhattan. The average rent for a three room apartment in Upper East Side is 3 $ 400 (3 026 euros(1)) per month, while a two-bedroom in the trendy Tribeca will cost you 5 582 dollars (4 969 euros) ! In Brooklyn, in the sector of BoCoCa nicknamed "Little France" due to the number of French residents, in a two-bedroom would cost you $ 2,500 (2 226 euros). Often, you will opt therefore for a roommate.

Read our complete file

move abroad to retire or to work ?

in New York, the rules of homeownership are well strange What you need to know before you go to work in Canada, Belgium, Switzerland... To make the furnished rental, invest in eastern Europe, it is profitable, Your support is essential. Subscribe for $ 1 support Ustaxation of non-trivial

As for the taxation, it is not negligible. The income tax is levied at three levels : federal, state, and municipal. At the federal level, the rates vary between 10 and 39.6 percent beyond a net income higher than 413 201 dollars (368 178 euros) for a single person. New York State levies a tax that goes from 4 to 8,82 % above 2 058 000 (1 833 784 euros), and the city of New York, at rates varying between 2.9 and 3.9 per cent, from $ 500,000 (445 526 euros). The declaration to fill in all of the years, despite deduction of tax at source made by the employer is of a bewildering complexity. These obstacles must not stop you because in New York, the american dream is real : we can climb the ranks at lightning speed and become rich in a jiffy.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

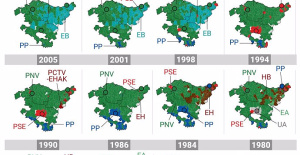

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness