Bitcoin and Ethereum ETFs have been making some serious cash money moves lately, raking in over a billion in net inflows. Like, that’s a lot of dough, man. This is the highest level of inflows since November 2024. On May 22, spot Bitcoin and Ethereum exchange-traded funds saw net inflows totaling more than $1 billion, which is pretty impressive if you ask me.

Bitcoin ETFs were the big winners here, with a daily inflow of $934 million, the best they’ve done since January 17. This boosted the total assets under management of spot Bitcoin ETFs to a whopping $104 billion. That’s a whole lotta Bitcoins, dude. The top dog in the ETF game was BlackRock’s IBIT fund, holding a massive 651,620 individual Bitcoins. They even managed to surpass Binance as the second-biggest Bitcoin holder. Whoa. Only Satoshi Nakamoto’s inactive wallet address has more Bitcoin, about 1.123 million. And get this, Michael Saylor’s Strategy is sitting pretty in fourth place with 576 Bitcoins. I mean, talk about making it rain in the crypto world.

Ethereum ETFs also saw some action, with net inflows of $110 million, the biggest gain in a single day since February 4. Leading the pack was Grayscale’s ETHE fund, bringing in $43.7 million in net inflows. This marked the fifth day in a row of positive inflows for Ethereum ETFs, holding a total of $10.07 billion in assets under management. Ethereum has been on fire lately, with a 44% gain since the beginning of May. Looks like people are still digging Ethereum, even with other tokens trying to get in on the ETF action soon. It’s like a crypto party and everyone wants to join in on the fun.

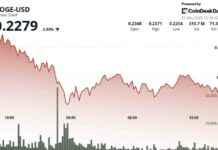

The traders seem to be all in on Bitcoin’s bull market rally, hitting an all-time high on May 22 at $111,970. Despite some turbulence in the stock market due to U.S. government debt and tariffs, the crypto market has been hanging tough. It’s like a rollercoaster ride, but with digital currency. So, yeah, things are looking pretty interesting in the world of crypto ETFs. Who knows what’s next? Not really sure why this matters, but hey, it’s all good in the crypto hood.