So, like, have you heard about all the drama going on in the crypto market these days? It’s wild! Apparently, there’s all this stuff happening with forced liquidations, hidden contracts, and backchannel deals that’s making everyone rethink how liquidity works and who they can trust. Like, seriously, it’s a mess out there.

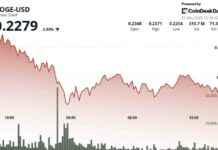

It all went down on May 17, 2025, at 8:41 a.m. when two major token blowups shook the market to its core. Movement Labs’ MOVE scandal and the collapse of Mantra’s OM sent shockwaves through the crypto world. People were freaking out because rapid price crashes exposed shady actors, sketchy token unlocks, and sneaky side agreements that left everyone in the dark. OM tanked more than 90% in just a few hours in late April for no apparent reason. Can you imagine losing that much value in such a short time? Yikes.

Unlike traditional finance where market makers keep things chill with bid-ask spreads on legit platforms, crypto market makers are playing a whole different game. They’re not just quoting prices; they’re making secret deals with projects before they even launch, locking up tokens, and pulling strings behind the scenes. It’s like a high-stakes poker game, but with digital coins. A recent exposé showed how Movement Labs execs teamed up with their market maker to dump $38 million worth of MOVE on the market. Shady, right?

Now, some firms are starting to wonder if they’ve been too trusting of their partners. How do you protect yourself when token unlocks are a mystery? What happens when sketchy handshake deals mess with the original plan? It’s a mess, for real. Market makers are changing up their game by having more in-depth talks with project teams and setting up safeguards against dodgy behavior. They’re all about long-term goals now, not just short-term gains. It’s a whole new world out there in the crypto market, and no one really knows what’s gonna happen next.