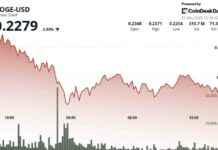

Bitcoin has seen a significant drop in price over the past day, causing many investors to feel anxious. The failure to break above the $68K resistance level has led to a consistent decline in the market. Currently, Bitcoin is trading around $50K and may soon test the $48K support level. Despite the oversold values on the RSI indicator, there is a possibility that the price could find a temporary bottom soon.

Looking at the 4-hour chart, we can observe a steep decline in price since breaking below the $60K support level. The market structure appears bearish, especially after breaking through the $54K low from July. However, the Relative Strength Index is signaling oversold conditions in this timeframe, indicating a potential consolidation above the $48K support level in the near future.

The futures market has played a significant role in Bitcoin’s recent price drop, with a large number of long positions being liquidated. This has led to a negative funding rate, the lowest seen in 2024. Negative funding rates can trigger a short liquidation cascade, possibly resulting in a rapid recovery in price. However, it is important to note that it may be premature to expect such a turnaround at this point.

For those interested in trading cryptocurrency, there are special offers available at various exchanges. For example, Binance is offering a $600 exclusive welcome offer for new users, while BYDFi Exchange has a limited offer of up to $2,888 as a welcome reward. It is essential to conduct thorough research and consider the risks involved before making any investment decisions.

In conclusion, Bitcoin’s price decline has raised concerns among investors, but there are indications that a temporary bottom may be near. The market sentiment remains bearish, influenced by factors such as funding rates and technical indicators. As always, it is crucial for individuals to stay informed and make informed decisions when trading cryptocurrencies.