U.S. stocks wrapped up Thursday on a mixed note as investors tried to make sense of the House’s close approval of President Trump’s hefty tax-and-spending package. The S&P 500 saw a slight dip of 0.04%, the Dow Jones Industrial Average stayed flat, and the Nasdaq Composite managed to edge up by 0.28%.

The bill in question, expected to balloon the federal deficit by nearly $4 trillion according to the Congressional Budget Office, encompasses significant tax cuts and a boost in military spending. Following last-minute tweaks, such as widened deductions for state and local taxes to sway conservative lawmakers, the legislation scraped through the House by a mere single vote and now heads to the Senate for further scrutiny.

Investor sentiment was somewhat dampened by another surge in Treasury yields, with the 30-year bond briefly soaring above 5.16%—its highest level since 2023—before easing. Meanwhile, the benchmark 10-year yield also saw a slight pullback to 4.55%. Analysts pointed out that lackluster demand at Wednesday’s 20-year bond auction played a role in the earlier sell-off in Treasurys, all while concerns about the sustainability of debt lingered in the background.

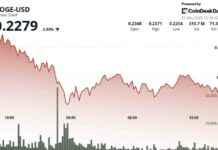

Not really sure why this matters, but Bitcoin (BTC) continued its jaw-dropping rally, crossing the $111,000 mark. The surge was fueled by optimism surrounding Senate developments on stablecoin regulation and buzz surrounding an event for Trump donors attended by big players in the crypto sphere. Surprisingly, the excitement among derivatives traders appeared somewhat muted compared to previous surges. Analysts observed that the gains were primarily driven by actual demand in the spot market rather than speculative trading, with indicators like long/short ratios and liquidations suggesting a moderate bullish sentiment.