The Bitcoin Mining Difficulty high reached a new all-time high. Conversely, this means that the Bitcoin network is as secure as ever – despite a 43-percent rate of residue at All Time High.

David-separator3. June 2019BTC$8.429,00 -3.04%part Facebook Twitter LinkedIn xing mail

A Bitcoin costs to the hour of approximately 8.550 to the U.S. Dollar. This is a 43 percent lower than during the BTC all-time highs in December 2017. And yet, the Mining Difficulty, the relative difficulty to calculate a valid Hash for a new Block of high reached a new all-time high. How do they fit together?

What is the Mining Difficulty isis the editorial deadline for the Difficulty about 7.459.680.720.543 according to data from blockchain.info. This value exceeds the past record of difficulty in October 2018 slightly. We are these days, consequently, witnessing a new Difficulty-all-time highs.

development of the Bitcoin Mining Difficulty since the launch of the Genesis block. Data source: https://www.blockchain.com/charts/difficulty?timespan=all&scale=1.The Mining Difficulty is, ultimately, a measure of the relative difficulty of finding a valid Hash just below the so-called Target Value in the Proof-of-Work algorithm. The lower the Target is, the more difficult it is to find a valid SHA-256 Hash for the current Block Header.

The Difficulty Adjustment is at the core of bitcoin algorithmic monetary policy. Because, as most know already, is to get every ten minutes a Block to the network and with the Block (current) to 12.5 freshly mined BTC. The more computing power to the network flows, the faster Bitcoin mines, so one would think. But all 2.016 blocks (approximately every two weeks) is the so-called Difficulty Retargeting. All of your Miner compare the actual number geminter blocks with the target. The actual time of exactly 20.160 minutes (2016*10 minutes) is below for 2016 blocks, the Difficulty is too high to assess. In the result, all the Miner to adjust the value for the Difficulty, so that on average a Block per ten minutes on the net.

you can call that in the medium term, there is no Miner in the world, worth more BTC to generate from the algorithm provided. This is the core of bitcoin monetary inflation policy.

Bullish tones from the Depths of the Bitcoin networkThe new all-time high is an indication of increased Mining activity. Finally, miners compete to Compute valid hashes; the more Miner part of the network, the higher the Hash Rate and the higher the medium-term Difficulty are.

The increased Mining activity is expected with the forthcoming Reward Halving in may 2020 in a context. Because starting in may of next year, the Coinbase Reward, so the largest part of the remuneration of the Miner for the security of the Bitcoin network is cut in half to 6.25 BTC.

It appears logical that Bitcoin Miner their strategy on this halving align, and in the run-up to try to accumulate as many BTC. Furthermore, the Bitcoin price rose in the past, in the course of the Halvings; it is assumed that the Miner withheld a portion of their BTC, and only at higher rates in the aftermath of the Reward-halving to the market.

if you want to learn more about the connection between course development and Reward Halving, the follow this Link.

Bitcoin & Altcoins to buy: , crypto currencies, buy, sell, or trade – we have selected the best Broker, stock exchanges and certificates: buy Bitcoin | Ether buy | Ripple to buy | IOTA buy | Broker-comparison

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

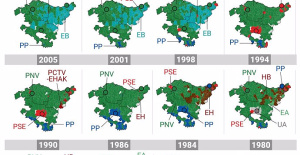

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness