6. March 2019BTC$3.854,04 -0.16%part Facebook Twitter LinkedIn xing mail

to tend to the Era of The Initial Coin Offerings (ICOs) seems to be your end. The big wave in 2017 is to a large extent subsided, only a few stable projects were able to live up to the Hype so far. In accordance with the dot-com bubble of the late 90s, you could say: Now the search for the needle in the haystack begins. But if you think that nothing more goes, is the next investment vehicle in the starting blocks: the Security Token Offerings – in short: STO.

Because these promise more safety. In contrast to the Coins of the ICOs you must have not advanced (and often non-existing) Use Case, but for tokenized bonds. Bitbond is the first company that got to BaFin for permission to call a STO.

Details of the STO

In a press release, the BTC-ECHO is present, Bitbond now Details. The crypto-loan-company merged first with the Solaris Bank. As you can see from the message, will get all the Token-holder quarterly variable payments and fixed annual distributions. The Bitbond tokens have also a validity of ten years. This means that Bitbond is obliged to buy back the BB1 Token to its original value of 1 Euro.

you can Buy the Token now, with Fiat currencies, Stellar lumen, Bitcoin and Ether. As the company promises more will receive all of the investors own account, on which the company pays additional dividends on a regular basis.

funding model of BitbondWho manages to get in the first round of financing, the waves according to the official Homepage already have an investment advantage (he will, of course, only after ten years, distributed). The grading is as follows:

1. Round of financing: 11.3. to 1.4. (or up to 1 Million Euro): € 0.70 (30% discount)2. Round of financing: 2.4. up to 8.4. (or up to 3 million euros): Euro 0.90 (10% discount)3. Round of financing: 9.4. up to 15.4. (or up to 5 million Euro): € 0.95 (5% discount)4. Round of financing: 16.4. up to 22.4. (or up to 9 million euros): EUR 0.97 (3 percent discount)Regular financing: 23.4. up to 10.5. (or up to 100 million euros): Euro 1.00 (regular price) Read also: Security Token Offering: Newfoundland and Ledger plan STO-Framework

The annual interest rate, Bitbond promises, is four per cent paid out in the Cryptocurrency Stellar Lumens (XLM). In addition, there is, however, the variable distribution of 60 percent of the net profit of the company.

buy Bitcoin , crypto currencies, buy, sell, or trade – we have selected the best Broker, stock exchanges and certificates: Now

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

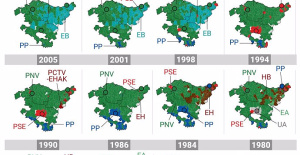

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness