The price of Bitcoin rose on the Morning of the 16. In June, more than 9,000 US dollars. So far, you can keep the price above this Level and rising even more. What can you say on the Basis of the Charts?

Dr. Philipp Giese16. June 2019BTC$No. 9.152,00 3.88%part Facebook Twitter LinkedIn xing mail

There, you will feel of the old cartoon series reminds us that Bitcoin is about US $ 9,000. After the price of Bitcoin by the end of may, tried to the beginning of June, to crack this Resistance, he was able to rise well above this Level. This is not to reach a new high for the year for 2019: Such price heights not seen in Bitcoin for over a year.

now to the moon? Without the day before the evening, praise, looks of the Chart promising (here on the example of the value of pair BTC/USD on Bitstamp with trading view shown):

A rising MACD, a rising RSI and a high Aroon-Up Signal is a bullish language to speak. It offers up-to-date a Long Position at which a Stop Loss on 8.334,76 US dollars is set and the two Resistances in to 9,948,98 U.S. dollars and 11.417,39 US use the Dollar as a Target. Only after a course fall under the Support in 7.523,16 US dollars, you should consider a Short Position in recital, in which the second Support 5.686,68 U.S. dollars as the Target is targeted, and as a Stop 8.334,76 US dollars of Loss re-serve.

long-Term development from the Bitcoin course: we're back in a bull market?as far as the short-term forecast. What can you say about the long-term development? Certainly, the next Halving will affect the Investment behavior to the Bitcoin strong. Nevertheless, there are some critical voices, which describe the development since the end of last year in the Form of an Elliot wave. This should come through the current upward movement to an end what a three-piece correction should connect. Some of the downward movements in the area of the above-mentioned second Support. Also, in accordance with the over a year ago, presented Monte-Carlo Simulation prices to 6,600 US are excluded to the Dollar at year-end:

A look at the DVAV-Ratio

In the several months ago presented DVAV Ratio was noted that this has not yet sunk deep enough. The floor was in the old bear markets only after a fall of this Ratio below two to happen. In contrast, the DVAV Ratio is more than two – and has increased in the last few weeks, even slightly.

A re-analysis of the data allows for an Alternative Interpretation: What if we are currently in the real Post-Peak bear market? Both the bull market of the end of 2013, as well as the 2011 learned about before the actual new all-time high, a Peak, a slight consolidation phase followed. With respect to the Peaks of the end of 2013, we are talking about the Interim all-time high, which was reached in April 2013. After that, the price of Bitcoin experienced a longer period of consolidation. A similar, although temporally closer to each other lying, you can tell from the first Bull Run, bitcoin.

so What, a daring Thesis, if that was always high by the end of 2017, only a harbinger in the same major market cycle? Such a behavior could be detect by using the DVAV Ratio. You should see that this rises extremely abruptly (in the lower illustration of blue as bullishes scenario marked):

The current Increase in the DVAV Ratio could also be just a fluctuation, similar to the behavior in mid-2014, signed as a lot of bids due soon scenario above in red. So we should observe this relationship in the next few weeks to see if we can again expect dramatic heights or further consolidation.

The MA20 in the weekly chart bull market

as far as the Concern says. What is to be noted however: The price of Bitcoin is now already for more than two months ago above the moving average of the last 20 weekends. Accordingly, although certainly with consolidations, however, do not expect dramatic price falls below the mentioned Level. Only when the exchange rate is falling again sustainably below to 5,600 US dollars, one can speak of a real continuation of the bear market. Until then, we keep it with Frank Sinatra: Fly me to the moon.

Attention: The crypto-compass is the first digital magazine for digital currencies and Blockchain Assets. He provides you with monthly exclusive assessments, Insights and comprehensive analysis of the current situation on the Blockchain- & crypto-markets. Only now and only for as long as the stock enough: In the monthly subscription, incl. FREE Bitcoin collector coin

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

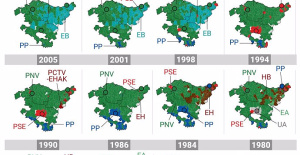

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness