U.S. Crypto Task Force to Deliver National Bitcoin Reserve

In a groundbreaking move that could have ripple effects across the globe, the U.S. is poised to establish a national bitcoin reserve, according to...

XBO Crypto Exchange to Sponsor Argentina National Football Team

The Argentine National Football Team has just scored a major goal in the sponsorship game, securing a partnership with the cryptocurrency exchange XBO.com. This...

President Milei Facing Fraud Charges for LIBRA Token Promotion

President Milei is currently embroiled in a legal battle as Argentine lawyers have filed fraud charges against him for his involvement in promoting the...

MSTR Eligibility for S&P 500 Inclusion in June

MSTR's Road to S&P 500 Inclusion: A Closer Look As the financial world eagerly anticipates the potential inclusion of MicroStrategy (MSTR) in the esteemed S&P...

XRP Ledger Dominates Crypto Market with SOLO Surge

The XRP Ledger (XRPL) ecosystem is making waves in the cryptocurrency market, with top assets like XRP, Sologenic (SOLO), and Coreum (COREUM) leading the...

Estonian Nationals Guilty in $577M Crypto Ponzi Scheme

Estonian Nationals Plead Guilty in Massive $577 Million Crypto Ponzi Scheme In a shocking turn of events, two Estonian nationals, Sergei Potapenko and Ivan Turõgin,...

Increased Wallet Accumulation for Wrapped AVAX (WAVAX) Post Bybit Card Cashback...

Summary: A surge in wallet accumulation of Wrapped AVAX (WAVAX) on the Avalanche blockchain has been observed, with nearly 4,000 wallets adding to their holdings—almost...

Hex Trust Acquires Byte Trading to Attract Institutional Investors

Hex Trust, a prominent digital asset financial services provider, has recently made waves in the industry with its acquisition of Byte Trading. This strategic...

Las Vegas Businessman Faces $24M Crypto Fraud Charges

Las Vegas Businessman Faces $24M Crypto Fraud Charges In a stunning turn of events, Las Vegas businessman Brent C. Kovar found himself at the center...

SEC Requests Coinbase Case Deadline Extension for ‘Potential Resolution’

The Securities and Exchange Commission (SEC) has recently filed a motion requesting an extension for the deadline in the ongoing case against Coinbase, indicating...

XRP Price Predicted to Drop to $1.80 Amid Meme Take-Off

XRP Price Outlook and Panshibi's Potential Take-Off As the crypto market continues to fluctuate, experts are predicting a possible drop in XRP's price to $1.80...

Predicted Surge in Lightchain AI and XRP Prices by Feb 2025

Cryptocurrency investors are abuzz with anticipation as both Lightchain AI and XRP gear up for a potential surge in prices by February 2025. These...

SafeMoon to Launch Memecoin on Solana After Burning Supply

SafeMoon, the once-celebrated cryptocurrency project, is set to make a significant move by launching a new memecoin on the Solana (SOL) network. This development...

Avenir Group Increases Bitcoin ETF Stake Amid Rising Institutional Interest

Avenir Group, a prominent institutional family office and investment management firm, has recently made waves in the world of cryptocurrency by significantly increasing its...

Top 4 High-Growth Crypto Investments for Best Returns

The cryptocurrency market is abuzz with excitement as February emerges as a pivotal month for investors seeking high-growth potential. Among the standout projects making...

BTC Bull Market Continues: 200-Week Average Trends Show Bitcoin Growth

Bitcoin's Bull Market Continues: Insights from 200-Week Average Trends In the fast-paced world of cryptocurrency, one key indicator is causing a buzz among investors and...

Investors Favor RBLK Over BNB for Stability

Investors are at a crossroads, torn between the recent resurgence of Binance Coin (BNB) and the steady allure of Rollblock (RBLK) in the ever-evolving...

Pioneering Global Innovation in Web3 and Blockchain Technology

Infinite Alliance: Revolutionizing Web3 and Blockchain Technology Infinite Alliance, a trailblazing venture studio for Web3, made waves at the recent WAGMI Conference in Miami, held...

HashFlare Co-Founders Plead Guilty in $577M Ponzi Scheme

Two Estonian nationals, Sergei Potapenko and Ivan Turõgin, have recently pleaded guilty to a $577 million Ponzi scheme involving their company Hashflare. The scheme,...

Top Crypto Pick: PEPE Investor’s Choice Under $0.50

A Crypto Enthusiast's Top Pick: Exploring the Potential of Rexas Finance In the vast and ever-evolving world of cryptocurrency investments, a recent Pepe coin (PEPE)...

Webull Brokerage Launches Kalshi Prediction Contracts for Bitcoin

Webull, a popular brokerage platform, has recently announced its partnership with Kalshi, a prediction market, to introduce event contracts to its users. This move...

BTC Miner Riot Platforms Appoints New Board Members for AI Pivot

Bitcoin mining company Riot Platforms has made significant moves to pivot towards artificial intelligence (AI) and high-performance computing (HPC), appointing three new directors to...

PENGU and POPCAT Launch on Coinbase Feb. 13

In a groundbreaking move, the popular cryptocurrency exchange Coinbase announced the upcoming availability of PENGU and POPCAT for trading on their platform starting on...

Undervalued AI Coin Gains Interest Amid Crypto Sell-Off

In the fast-paced world of cryptocurrencies, where market fluctuations can make or break fortunes in a matter of hours, investors are always on the...

USDC Stablecoin Market Cap Surges Past $56B

The USDC Stablecoin Market Cap Soars to Over $56 Billion In recent weeks, the USDC and USDT stablecoins have seen a surge in minting activity,...

Bitcoin Market Analysis: VanEck Predicts 247k BTC Buy Boost

A potential $23 billion surge in Bitcoin purchases, equivalent to 247,000 BTC, looms on the horizon as VanEck's analysis of 20 state-level Bitcoin reserve...

Enhancements for Creators & Brands in Metaverse: The Sandbox Updates

Los Angeles, United States, California, February 12th, 2025—The Sandbox, a popular social gaming metaverse where creativity and connectivity converge, has just unveiled a groundbreaking...

BTC Price Outlook: Soft U.S. CPI May Boost Bitcoin

Summary: A soft U.S. inflation report is expected to impact various financial markets, including Bitcoin. While lower-than-expected data could lead to positive outcomes for risk...

Starknet’s zkLend Hack: Recovering $8m Losses

Starknet's zkLend Hack: A Tale of Loss and Legal Action In a shocking turn of events, zkLend, a prominent Starknet-based layer2 money-market protocol, recently fell...

Cardano ETF Grayscale Files: Coin to Mirror Solana Surge

Grayscale, a renowned investment firm, has recently made headlines in the cryptocurrency market by filing for a Cardano ETF. This move has sparked excitement...

Canary’s Solana ETF Advances in SEC Review

Canary Capital's Proposed Solana ETF Advances in SEC Review Canary Capital's proposed Solana ETF has taken a significant step forward in the Securities and Exchange...

The Future of Ethereum: Analysis on ETH’s Revival

Ethereum, the second-largest cryptocurrency by market capitalization, has been struggling to break above the $2,700 level, even as Bitcoin remains resilient and the broader...

Exclusive Partnership: Gate.io and Red Bull Racing Team Up

Gate.io and Red Bull Racing Form Exclusive Partnership In a groundbreaking move that merges the worlds of cryptocurrency exchange and Formula One racing, Gate.io has...

Analysts Predict High Odds of XRP, DOGE, LTC ETF Approval

Indications Point to High Probability of XRP, DOGE, LTC ETF Approval In a recent analysis by seasoned ETF analyst James Seyffart, the odds of a...

Gumi Plans $6.6m Bitcoin Purchase Amid Tokyo Listing

Japanese game studio Gumi Inc. is making waves in the cryptocurrency world with its recent decision to invest $6.6 million in Bitcoin. This move...

Panshibi: Coinbase Listing Could Explode Meme 25x by March

Panshibi: The Rising Star in the Meme Coin Universe Panshibi, often abbreviated as $SHIBI, has emerged as the latest sensation in the world of meme...

Alabama Man Pleads Guilty in SEC Bitcoin Hack

On a February night in 2025, Eric Council Jr., an Alabama man, found himself at the center of a high-profile case involving a cyber...

Comparing BeerBear and Dogecoin in Meme Coin Market Trends

Dogecoin, once the star of the meme coin market, is now struggling to regain momentum. Enter BeerBear, a new player in the crypto space...

South Korean Lawmaker Escapes Crypto Disclosure Charges

A South Korean lawmaker, Kim Nam-kuk, recently made headlines after being acquitted of charges related to concealing his cryptocurrency holdings. The court ruled that...

BTC Indicator Turns Bearish Amid Trump’s Trade War Rhetoric

The recent shift in Bitcoin's key indicator signals a potential bearish trend, coinciding with President Donald Trump's tariff rhetoric that could impact market stability....

Presale Token Matching Shiba Inu Rally Target

Lightchain AI’s recent presale, which raised an impressive $15.3 million, has ignited speculation within the crypto community that it could be the next big...

Top Cloud Mining Service Provider for Profitable Bitcoin Mining

Cloud mining has become a popular way for individuals to increase their passive income through cryptocurrency investments. It offers the opportunity to grow wealth...

RWA Tokenization Growth Accelerating Towards Trillions

A recent report from Security Token Market has projected a significant surge in asset tokenization, with estimates reaching $30 trillion by the year 2030....

Top Cryptocurrencies to Watch During Bull Run.

As the crypto market gears up for a potential bull run in 2025, investors are keeping a close eye on promising altcoins that could...

High-Retention Video Views: How to Get More Watch Time Without Clickbait

If you’re getting clicks but people leave after 20–40 seconds, the issue usually isn’t “the algorithm hates me.” It’s retention. Platforms like YouTube, TikTok,...

Is This Token the Next Crypto Market Disruptor? Crypto Whales Accumulating

Cryptocurrency enthusiasts are all abuzz about a potential market disruptor that has caught the attention of savvy investors known as crypto whales. These large-scale...

B3 Launching BTC Options, ETH & SOL Futures

Brazil’s leading stock exchange, B3, is gearing up to broaden its cryptocurrency offerings by introducing bitcoin (BTC) options and futures contracts for ether (ETH)...

XYZ Unites Sports Fans and Crypto Investors Amid TRUMP Coin Controversy

XYZVerse: Where Sports Fans and Crypto Enthusiasts Unite Amid TRUMP Coin Controversy The world of cryptocurrency recently witnessed a whirlwind with the launch of TRUMP,...

B3 Launches Bitcoin Options and Altcoin Futures in Brazil

Brazil's B3 Launches New Crypto Offerings, Embracing Bitcoin Options and Altcoin Futures Brazil's largest stock exchange, B3, is making waves in the financial world by...

Gold-Backed Crypto Surges as Wall Street Forecasts $3,000 Prices

Gold-backed cryptocurrencies are on the rise as Wall Street predicts $3,000 prices for the precious metal. With major financial institutions adjusting their forecasts due...

Top Altcoins to Buy as Thailand Trials Crypto Trading

Thailand's recent foray into the world of crypto trading has ignited a fresh wave of enthusiasm in the altcoin market. As the country delves...

Gamified DeFi Experience: Flare Fair Launch on Live Bitcoin News

Flare Fair: Revolutionizing DeFi with Gamified Experience Flare Fair has recently launched, offering a virtual DeFi experience like never before. This innovative platform introduces users...

State Progresses Towards Crypto Reserve; Others Follow Suit

State Progresses Towards Crypto Reserve; Others Follow Suit Utah recently made headlines by passing a groundbreaking digital assets bill through the state house, marking a...

Catzilla Presale: Early Buyers Secure Steep Discounts

In the bustling world of cryptocurrency, a new player has emerged to challenge the status quo and disrupt the meme coin kingdom. Catzilla, a...

Maryland Bitcoin Reserve Fund Proposal in Legislative Bill

Maryland Bitcoin Reserve Fund Proposal Seeks to Strengthen State Financial Security In a groundbreaking move, Maryland has put forth the Strategic Bitcoin Reserve Act, a...

People-Powered AI: Democratized, Depoliticized, Decentralized – A Guide

Access to AI intelligence should be equal to all. That means building collaborative systems of learning, like the Thames Network, a new decentralized AI...

XYZVerse: The Next Big Move for Profitable Investments

XRP, a well-known cryptocurrency, is experiencing significant sell-offs, leading to uncertainty among traders about its future. As investors seek the next big opportunity, XYZVerse,...

Japan Regulates Crypto Apps: Apple, Google Ordered to Remove Unregistered Apps

Japan's Financial Services Agency (FSA) has recently made headlines by ordering tech giants Apple and Google to remove unregistered cryptocurrency exchange apps from their...

Bitcoin (BTC) struggles, Gold eyes weekly gain amidst job data.

Bitcoin (BTC) Struggles, Gold Eyes Weekly Gain Amidst Job Data As the world of cryptocurrency continues to captivate investors and traders alike, Bitcoin (BTC) finds...

Ethereum’s Buterin Frustrated with Community’s ‘Degen Casino’ Obsession

Ethereum Co-Founder Vitalik Buterin Voices Frustration Over Industry's 'Degen Casino' Obsession In recent news, Vitalik Buterin, the co-founder of Ethereum, has expressed his exasperation with...

Understanding Cryptocurrency Market Trends: Bitcoin, Ethereum, and Panshibi Updates

Cryptocurrency Market Trends: Bitcoin, Ethereum, and Panshibi Updates The world of cryptocurrency is abuzz with activity as Bitcoin, Ethereum, and Panshibi make waves in the...

Ethereum Pectra Upgrade Testing Starts February

Ethereum’s Pectra Upgrade: A New Chapter for the Blockchain In the fast-paced world of cryptocurrency, every upgrade, every development, holds the potential to shape the...

From Student to Success: $577 to $70k with Viral PEPE Competitor

A Remarkable Journey: From Student to Success with Crypto Investments In a world where cryptocurrencies can be as unpredictable as the weather, a college student...

USDT Adoption in UAE Real Estate: Tether Signs MoU with Reelly...

Tether Collaborates with Reelly Tech to Revolutionize UAE Real Estate Transactions In a groundbreaking move that is set to transform the landscape of real estate...

Trump’s Plan to Lower 10-Year Yield: Bitcoin Implications

Summary: The Trump administration aims to lower the 10-year yield to boost the economy by controlling inflation and fiscal spending. Treasury Secretary Scott Bessent...

Berachain Launches on Upbit and Bithumb in South Korea

In a bustling digital landscape where cryptocurrency exchanges are constantly evolving, South Korea's Upbit and Bithumb have made a significant move. On Feb. 6,...

Altcoin Poised for Growth Amid Market Uncertainty

Investors Seek Growth Amid Crypto Market Uncertainty Amid a backdrop of market volatility and uncertainty, investors are turning their attention towards alternative assets to protect...

Ending the Bureaucrat’s Secret Weapon: Debanking

Nathan McCauley, CEO of Anchorage Digital, recently testified before the Senate Banking Committee in a hearing focused on the impacts of debanking in America....

Dogecoin Surges 15% After Market Rebound, Eyes $0.50

Dogecoin and XYZVerse: A Tale of Two Cryptocurrencies In the ever-evolving world of cryptocurrency, two tokens have recently captured the attention of investors and enthusiasts...

Revolutionary Gaming Collaboration: HyperCycle and TGC Join Forces

In a groundbreaking move, HyperCycle and TGC have joined forces to deploy 1 million Node Factories, transforming the landscape of AI-powered gaming with increased...

CFTC Acting Chair Pham: Regulation Shifts Away from Enforcement

CFTC Acting Chair Pham: A Shift Towards Fraud Prevention In a recent announcement on February 4, 2025, at 10:03 p.m. UTC, Caroline Pham, the Acting...

Next big Solana meme coin: AI Companions trend.

The latest craze in the crypto world has arrived with the surge of AI Companions and the buzz surrounding the potential next big Solana...

Hong Kong Securities Watchdog Expanding Crypto Team

The Hong Kong Securities Watchdog Expands Crypto Team to Boost Regulation and Foster Global Digital Asset Hub Development In a move to keep pace with...

Protect Yourself: How to Avoid Coinbase Social Scams

Coinbase Users Beware: Protecting Yourself from Social Scams In recent months, Coinbase users have fallen victim to a wave of social engineering attacks, resulting in...

Ondo Price Increase: Reasons and Impact

Ondo Finances: A New Era of Growth and Innovation In the ever-evolving world of cryptocurrency, Ondo Finance has recently made waves with a significant rebound...

ChainGPT & Binance Pay Rewards Giveaway Collaboration

In an exciting development on February 4th, 2025, ChainGPT, a pioneering blockchain AI solutions provider, revealed its collaboration with Binance Pay, a secure cryptocurrency...

Top 10 Rules for Federal Securities Compliance

In the ever-evolving landscape of U.S. financial markets, the need for a seismic shift in regulatory frameworks has become more apparent than ever before....

Understanding Trump Token: Official Cryptocurrency Explained

The recent launch of the Official Trump cryptocurrency, a meme coin associated with the President of the United States, Donald Trump, has sent shockwaves...

El Salvador Buys 2 More Bitcoin Post IMF Deal

El Salvador's Recent Bitcoin Moves Post IMF Deal El Salvador, a country at the forefront of Bitcoin adoption, has been making headlines recently for its...

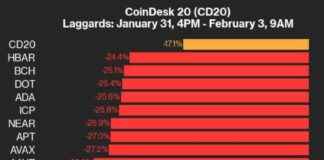

CoinDesk 20 Index Plunges 17.1% Weekend Performance Update

The cryptocurrency market witnessed a significant downturn over the weekend, with the CoinDesk 20 Index plummeting by 17.1%. This sharp decline left investors reeling...

Customized Crypto Options Service by DWF Labs

DWF Labs Revolutionizes Crypto Options Trading with Customized Service In a groundbreaking move, crypto market maker DWF Labs has introduced DWF Options, a pioneering service...

Revolutionizing Crypto Payments in Europe: Binance Pay and xMoney Partnership

Binance Pay and xMoney Join Forces to Revolutionize Crypto Payments Across Europe In a groundbreaking move that is set to reshape the landscape of cryptocurrency...

BTC Price Falls 8% to $93K Amid Asia’s Trade Concerns

Bitcoin Price Plummets 8% to $93K Amidst Asia's Trade Concerns In a turbulent start to the week, major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH),...

Top Cryptocurrency Investments: Jupiter, VeChain, New Altcoin

The world of cryptocurrency is a dynamic landscape, constantly evolving with new opportunities and investments. In the realm of digital assets, where innovation and...

Sam Bankman-Fried Appeals Conviction for Judicial Bias

Sam Bankman-Fried, the prominent figure behind FTX, has recently lodged an appeal, challenging his conviction on the grounds of judicial bias and an unfair...

Bitcoin Price Plummets as Trump Launches Trade War

Bitcoin's Price Plunges Amid Trump's Trade War Tensions Bitcoin, the leading cryptocurrency, has taken a nosedive to $100,000 as President Donald Trump initiates a trade...

Official Trump Coins: Total Supply and Varieties Available

The cryptocurrency world was recently shaken by the launch of the Official Trump token, marking the first time a token was officially associated with...

Top 4 Crypto Gems to Buy Today: BDAG, BNB, SHIB &...

In the fast-paced world of cryptocurrency, Bitcoin and Ethereum often steal the spotlight with their massive market presence. However, as 2022 unfolds, a new...

Blueprint for Cryptocurrency Market Organization

In the rapidly evolving landscape of digital assets, the need for clear and comprehensive legislation and regulation has never been more pressing. As we...

XRP Remittix: Maximizing Returns in International Payments

Cryptocurrency enthusiasts are abuzz with excitement as XRP and Remittix take center stage in 2025, showcasing significant growth potential despite recent market fluctuations. The...

Top 4 Altcoins with 10x Potential to Buy Now

The cryptocurrency market is abuzz with excitement as investors seek out the next big opportunity to potentially 10x their net worth. Among the myriad...

Cryptocurrency Market Update: Ripple’s Impact and Stablecoin Growth

It was a whirlwind week in the world of cryptocurrency, with Ripple making significant waves and stablecoins experiencing a surge in growth. As the...

Las Vegas Sphere denies Dogwifhat partnership: details

Las Vegas Sphere Refutes Dogwifhat Partnership Rumors: The Inside Scoop In a recent turn of events, a spokesperson for the Las Vegas Sphere has vehemently...

Malaysia Implements Blockchain and AI for Anti-Corruption Measures

Summary: Malaysia is leading the way in the fight against corruption by implementing blockchain technology and artificial intelligence (AI) to enhance transparency, improve investigations, and...

Parents of FTX Founder Sam Bankman-Fried Seek Trump Pardon for Son

Sam Bankman-Fried, the 32-year-old founder of FTX, has found himself in a legal quagmire following the collapse of his crypto empire. With his parents,...

Lost $12m in Meme Coin Blunder: Ross Ulbricht-Linked Wallets

In a recent crypto blunder that made headlines across the digital currency world, wallets tied to Ross Ulbricht, the notorious Silk Road creator, lost...

Ultimate Meme Coin Guide: Best Buy for Massive Returns in 2021

In the fast-paced world of cryptocurrency, meme coins are making a serious impact as more than just a passing trend—they are emerging as potentially...

Purchase Official Donald Trump Merchandise Using TRUMP Memecoin Token

TRUMP Memecoin Token Opens Doors to Official Donald Trump Merchandise Amidst the ever-evolving landscape of cryptocurrency, a groundbreaking development has emerged. TRUMP Memecoins, a token...

Lightchain AI: Potential for Major Gains in Dogecoin-Like Surge

Lightchain AI: The Next Frontier in Cryptocurrency Investment As the cryptocurrency market continues to evolve, investors are constantly on the lookout for the next big...

Top 4 Cryptos for Explosive Growth in 2025: Buy Today

In the fast-paced world of cryptocurrency, the race to uncover the next big thing is always on. As the 2025 bull market approaches, investors...

Bitcoin Price Surges to $102,500 After Federal Reserve’s Interest Rate Decision

Bitcoin Price Skyrockets to $102,500 Following Federal Reserve's Interest Rate Decision In a surprising turn of events, the price of Bitcoin soared to an all-time...

Investors Flock to New Gem Following Huge Returns: SHIB and SOL...

Investors Flock to New Gem Following Huge Returns: SHIB and SOL Trend In the fast-paced world of cryptocurrency, where fortunes are made and lost in...

Czech National Bank Contemplates 5% Bitcoin Reserves

Czech National Bank Considers Groundbreaking Bitcoin Investment The Czech National Bank is on the verge of making history by contemplating a significant investment in Bitcoin....

EFF Calls for Dismissal of Roman Storm in Tornado Cash Case

The Legal Battle Over Tornado Cash: EFF Advocates for Roman Storm In a groundbreaking legal showdown, the Electronic Frontier Foundation (EFF) is calling for the...

Is Bitcoin a Buy? Jim Cramer Predicts BTC Dip Coming

Jim Cramer: The Man, the Myth, the Contrarian In the ever-evolving world of investments, one name stands out as both a beacon of hope and...

DeFi Domination: Solana Strengthens, Ripple Aims for $5 in 2025

DeFi Domination: Solana Soars, Ripple Eyes $5 in 2025 The world of cryptocurrency is abuzz with positive sentiment, particularly as top altcoins like Solana (SOL)...

French Prosecutors Investigate Binance for Money Laundering and Tax Fraud

French Prosecutors Probe Binance for Money Laundering and Tax Fraud French authorities have ramped up their investigation into global cryptocurrency exchange Binance, delving into allegations...

Ultimate Guide for Investors to Navigate the 2025 Crypto Bull Run

The year 2025 promises to be a landmark year for cryptocurrency investors, with the market gearing up for unprecedented growth. As the crypto landscape...

Arizona Senate Passes Bill to Invest 10% of Public Funds in...

Arizona Senate Passes Bill to Invest 10% of Public Funds in Bitcoin In a groundbreaking move that could reshape the state's financial landscape, the Arizona...

Bessent, Trump’s Treasury Secretary, Set to Address Taxes Ahead of Crypto

**Bessent, Trump's Treasury Secretary, Unveils Tax Approach Amid Crypto Uncertainty** Scott Bessent, the newly appointed head of the Treasury Department under President Donald Trump's administration,...

PayPal’s PYUSD Stablecoin Integration with Cardano’s Ecosystem

PayPal's PYUSD Stablecoin Integration with Cardano's Ecosystem PayPal USD stablecoin has expanded its reach to the Cardano ecosystem through a new cross-chain bridge developed by...

XRP Price Holds Steady as RCO Finance Surges with 50,000% Growth...

XRP Price Holds Steady as RCO Finance Surges with 50,000% Growth Potential In the fast-paced world of cryptocurrency, the XRP price remains a beacon of...

Cryptocurrency News: DOGE and XRP Prices Drop 11% Amid $770 Million...

Cryptocurrency Market Takes a Hit: DOGE and XRP Prices Plummet by 11% Amid $770 Million in Crypto Liquidations In a tumultuous start to the week,...

DeepSeek: How Hayes’ Comments Could Impact Investor Sentiment

BitMex CEO Arthur Hayes recently sparked discussion on the potential impact of DeepSeek AI, a Chinese counterpart to OpenAI, on investor sentiment towards US-based...

Exploring Blockchain for Government Transparency: Musk’s DOGE Initiative | Live Bitcoin...

Elon Musk's Department of Government Efficiency (DOGE) is spearheading a groundbreaking initiative to leverage blockchain technology in an effort to revolutionize federal operations. The...

The Latest Update on Crypto: Analysis of Trump’s Second Week

On January 25, 2025, Donald Trump, the 47th President of the United States, marked his second week in office with a series of impactful...

How Trump’s Crypto Success Could Boost Lightchain AI: Key Insights

Trump's Impact on Crypto Market and Lightchain AI's Rise In a whirlwind of headlines dominated by former President Donald Trump's foray into the cryptocurrency world,...

John McAfee’s $AINTI Token Controversy: Pre-Launch Update

John McAfee's AIntivirus Token Sparks Debate In a surprising turn of events, the social media account of the late cybersecurity pioneer, John McAfee, recently announced...

Crypto Attorney Debunks Gambling Concerns in Prediction Markets

Attorney Disputes Gambling Label on Prediction Markets Attorney Aaron Brogan has recently sparked controversy by challenging the categorization of prediction markets as gambling platforms. Despite...

Bitcoin Price Analysis: Support at $97K, All-Time High (ATH) Imminent?

Bitcoin Price Analysis: Will BTC Hit All-Time High Soon? Bitcoin, the world's most popular cryptocurrency, is currently at a crucial juncture as it hovers around...