Get crypto-Broker soon finally approved? The U.S. securities and exchange Commission SEC and the approval authority FINRA expressed to the persistent delays. An early registration is therefore not in sight. The official Statement is, nevertheless, insight into regulatory dilemmas.

By Anton Livshits9. July 2019BTC$12.267,00 3.28%part Facebook Twitter LinkedIn xing mail

Bitcoin is aiming at the American stock exchanges. Numerous companies hope to be able soon, the Broker role for the stock market trading with crypto-Assets to take. For this purpose, they have submitted the appropriate applications. As you know, the authorities reacted to this, only behavior. The permits are still pending.

The securities and exchange Commission United States Securities and Exchange Commission (SEC), as well as the approval authority, Financial Industry Regulatory Authority (FINRA) expressed on the 8.7 in a public statement to the continuing delays. The O-sound: The stock exchange trading with crypto-Assets poses additional regulatory problems for which a satisfactory solution is still pending. In the centre of the regulatory concerns of the Customer Protection Rule the SEC is.

This customer protection rule is the protection of investors:

SEC certified crypto-Assets insufficient customer protectionthe purpose of the customer protection rule is to protect customer securities and funds in possession of a broker dealer, to prevent investor losses, or damages in the event of bankruptcy of a broker dealer, and to improve the ability of authorities to Monitor and prevent unfair business practices. In simplified terms, the customer protection rule, Broker-dealers, that they protect customer assets and customer's separate assets from the assets of the company, which increases the likelihood that the securities and cash of the customer in the event of bankruptcy of the Broker-Dealers may be returned to you.

The SEC is seeing in terms of crypto-Assets difficulties, the Customer Protection Rule to implement. This is, above all, questions of safe-keeping. The authors of the report note that Bitcoin exchanges were repeated steels will be the target of Hacks and a thief. The SEC and FINRA, however, also with other concerns to face.

Some of them relate to the digital Nature of crypto-Assets. The report expressly points out that the authorities distinguish between the shape of securities. For digital Assets the same regulatory Standards as those in paper form apply. From this, however, difficulties arise. The unique ownership of a digital asset could be demonstrated according to the SEC, only difficult. Finally, it is not excluded that still other copies of the Private Keys are in circulation. Also in the accounting of the opinion of cryptographic certified Broker similar difficulties.

SEC and FINRA to show a co-operativein addition to the just outlined problems, the opinion relates to a number of other questions. So also such Broker-models will be discussed, without a custody of the Assets.

Ultimately, the authors of the report not to designate a clear period of time in the with permits is. All in all, signal SEC and FINRA, however, a continued commitment to the conversation: "The special circumstances under which a Broker-Dealer Digital Asset Securities in a manner that could keep the employees [SEC and FINRA] to believe that they would correspond to the customer protection Directive, will continue to be discussed, and the employees are willing to continue to be in touch with companies that pursue this business."

Attention: The crypto-compass is the first digital magazine for digital currencies and Blockchain Assets. He provides you with monthly exclusive assessments, Insights and comprehensive analysis of the current situation on the Blockchain- & crypto-markets. Only now and only for as long as the stock enough: In the monthly subscription, incl. FREE Bitcoin Whitepaper (German version printed)

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

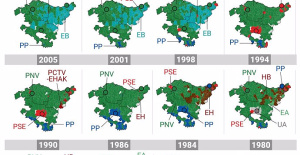

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness