In December 2017, the market participants are eager to see that the total market capitalization of the crypto-market 1 Bio. US dollars (882 billion Euro). Now, in December 2018, is fighting the overall market capitalization in order to keep the mark of 100 billion US dollars (88,2 billion Euro).

This is the complete reversal of the mood within a year: Last year, the fear to miss the train, it was. This year, it is the fear of losing all the money you have invested in crypto-currencies.

The Extreme of a bull or bear phase and is below the technical targets on the markets. We believe that the decline has reached a state of Panic, you will probably end soon.

investor faith in the long-term potential of the asset class, and should therefore prepare for an investment when the decline comes to an end. The risk of a decline from current levels is limited, while the upside potential is attractive.

EOS/USDEOS (EOS)-block producers are working with negative margins and many will not get problems, if the price recovers or the existing reward system is not changed.

Also, hackers have a rich and productive time with the decentralised Apps (DApps), which is based on the EOS-Blockchain. The hack attacks have led since July to a loss of about 1 million US dollars (880,000 euros).

Charles Hoskinson of Cardano believes that the U.S. securities and exchange Commission (SEC) probably against the 4-billion - US-Dollar (3.5 billion Euro) Initial Coin Offering (ICO) of the EOS. What is the future of the Charts, according to? Let us find out.

The main trend for the EOS/USD Pair is decreasing. The course has achieved since the case under 4,493 dollars (3,971 EUR) to new lows for the Year.

The cops had tried from mid-August to mid-November, to form a floor, and failed. The pattern target for this decline was 2,1561 US Dollar (1,9056 Euro). The bears broke through this level, however, effortlessly, and let the digital currency to a Low of 1.55 to the US Dollar (EUR 1.37). Also on this level, the buyer does not intervene to provide support.

The evidence suggests that the decline to the next support at 1.20 to the US Dollar (1,06 Euro) to 1 US Dollar (EUR 0.88) can extend, which is an important psychological mark. The RSI is near the oversold area. This shows that there were already more than enough sales.

A Pullback on the decline in level is likely to be. In this case, the Zone is located between 3,8723 US Dollar (3,4224 Euro) and 4,493 dollars (3,971 EUR). Traders should, however, be open only Long positions, when the virtual currency signals a trend reversal. Until then, it is to be seen best.

BNB/USDBinance, one of the world's leading crypto exchanges by trading volume, has brought out educational materials to the Public, "unbiased" information about crypto and the Blockchain. The content will be developed by the Binance Academy, which is a special Bildungsarm the stock exchange.

another branch, namely Binance Labs, has released a first series of Blockchain projects from its incubator program, which has provided the projects with funding and other necessary resources. The stock market has added six new pairs. The USD-based Stablecoin USD Coin of the Circle was recorded recently in the combined Stablecoin market.

The Binance Coin (BNB/USD) Pair is relatively strong, as in the case of under the Low of the 6. February has not moved from 5,4666 US Dollar (4,8315 Euro) great. It is currently in a descending channel.

stretch When the bears come under the direct support of 4,1723848 US Dollar (3,6876 Euro), the decrease to the support line of the channel at $ 2.50 (2.20 Euro).

Though the Trend is declining and the bears have the upper hand, the RSI is in the oversold area. Therefore, we can expect that the bulls will try to climb in 5,4666 US Dollar (4,8315 euros) on the overhead resistance. If that succeeds, may be referred to the current decline as a bear trap, and the Pullback may extend up to the resistance line of the channel, which is just about 7,50 US dollars (€6.61). Traders should try to Trade only when a reliable purchase constellation.

TRX/USDTRON (TRX) opened this week its TRC20-exchange. By the Start of the stock market, the liquidity of the TRON is expected to rise network. The 24-hour transaction volume in DApps increased compared to the previous week, 48 per cent. The 24-hour trading volume rose compared with last week, was 151 percent. Like looks in such a development of the chart pattern? A bottom is in sight?

The cops have been trying in recent months to form a bottom. The TRX/USD Pair consolidated between 0,0183 US Dollar (0,0162 euros) and 0,0281551 US Dollar (0,0249 Euro) for about three months before on 19. November continued to decline. An attempt to climb back in the range, failed. The bears are trying, therefore, the down-trend to continue. Due to the decline in a pattern target of 0,00844479 US Dollar (0,0075 euros). If the decline to this level will not come to a standstill, then the next support at 0,00554133 US Dollar (0,0049 Euro).

will be If the bulls can, however, defend the level of 0,01089965 US Dollar (0,0096 Euro) and the course on 0,0183 US Dollar (0,0162 euros), the digital currency is likely to reverse this trend. Until then, there will be any Pullback many sales. Therefore, it is better to wait and watch.

LTC/USDLitecoin (LTC) Lightning Network is now ready and can start on one of the largest payment Gateways, namely, CoinGate,. Charlie Lee, Creator of Litecoin, hailed this news in a recent Tweet: "Even Litecoin will soon have more than 1000 dealers, the LN-accepting payments! Thank You @CoinGatecom!"

Lee had sold his Litecoin in December of 2017, complete a conflict of interest as the reason. He had then indicated indirectly that the Litecoin exchange rate to US $ 20 (17,64 Euro) could fall. Of course now that he is close to Lee's prediction, a Bothe find or continue to fall? Let us find out.

The LTC/USD Pair is in a strong downward trend since it reached in December last year at US $ 370 (326 euros), an all-time high. Although it has been tried to form a bottom at 47.246 US $ (41,757 Euro), the bears, the Pair on 13. November continue to decline and the downward trend continued. There was a further attempt to defend the support at 29.349 US Dollar (25,939 Euro), but these could not hold up once a week.

Currently, the downward trend will continue and the next support below the Zone of between US $ 19 (Euro 16.76) and US $ 21 (€18.52). If those can not hold, it can extend the decline to 15 US dollars (13,23 Euro). The RSI is in the oversold area at a level that was last reached in early 2015.

If the digital currency from the current levels will jump back up and over 29.349 US Dollar (25,939 Euro), that suggest that the markets have rejected lower levels. In such a case, a Pullback on 47.246 US $ (41,757 Euro) is likely to be. Since the bears have the upper hand, traders should wait until the Trend reverses, before you open a Long Position.

BTC/USDSome believe that Bitcoin (BTC) to the severe bear market will end. Jeremy Allaire, the co-founder of the Circle, however, believes that Bitcoin will be in the next three years, "a lot more" value than it is now.

Thomas Lee, a co-founder of the Fund, Global Advisors is of the view that the market value of Bitcoin between of 13,800 dollars (12.170 EUR) and 14,800 US Dollar (13.052 Euro). Well over 315 percent more than the current level. In periods of bear markets, the prices can fall to crazy levels, which could prove to be a good buying opportunity for the Brave, the daring, to go against the Trend.

The Trend in BTC/USD Pair is clearly on the decline. Since the fall below the critical support at 5,900 US dollars (€ş 5,203. Euro) were able to defend the cops no intermediate support levels. This shows that the bears have the upper hand.

The sales have pushed the RSI in the oversold area. He is on a level that was last reached in early 2015. The immediate support lies at 2.974 US Dollar (2.622 Euro), from where we expect a sharp jump back up to the top.

If the virtual currency is not recovered, however, may extend the downward trend to 1.752, US Dollar (1.545 euros). In the case of any decline in the Pair is approaching a floor, but it is difficult to predict where the decline will end.

Since the decline was very solid, it is likely that the next Pullback is just as solid. Therefore, traders can expect a re-Test of the decline in levels of 5,900 US dollars (€ş 5,203. Euro), as soon as the Trend reverses. Until then, the Short traders will strike at every small Pullback.

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency

Exploring Cardano: Inner Workings and Advantages of this Cryptocurrency Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million

Seville.- Economy.- Innova.- STSA inaugurates its new painting and sealing hangar in San Pablo, for 18 million Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT

Innova.- More than 300 volunteers join the Andalucía Compromiso Digital network in one month to facilitate access to ICT Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets

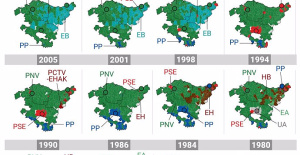

Innova.-AMP.- Ayesa acquires 51% of Sadiel, which will create new technological engineering products and expand markets Historical results of the 2024 Basque elections, municipality by municipality

Historical results of the 2024 Basque elections, municipality by municipality Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it"

Iran assures that any action by Israel will have an "immediate and highest level" response: "They will regret it" The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years

The Ciudad Real Court sentences the man who killed a thief with two shots in his home to 6 years PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan

PP and PSOE clash in the Senate over Koldo's appearance after a socialist writing on a work plan How Blockchain in being used to shape the future

How Blockchain in being used to shape the future Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on

Not just BTC and ETH: Here Are Some More Interesting Coins Worth Focusing on Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami

Valencia displays its "innovative and technological potential" at the Emerge Americas event in Miami The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine

The CSIC incorporates the challenges of robotics, nanotechnology and AI in the new strategic plan for biomedicine Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion

Innovation allocates 9.1 million to train 74,000 people and guarantee digital inclusion LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination

LIFE SPOT manages to develop new green treatments that eliminate groundwater contamination A million people demonstrate in France against Macron's pension reform

A million people demonstrate in France against Macron's pension reform Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia

Russia launches several missiles against "critical infrastructure" in the city of Zaporizhia A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore

A "procession" remembers the dead of the Calabria shipwreck as bodies continue to wash up on the shore Prison sentences handed down for three prominent Hong Kong pro-democracy activists

Prison sentences handed down for three prominent Hong Kong pro-democracy activists ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years

ETH continues to leave trading platforms, Ethereum balance on exchanges lowest in 3 years Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion

Investors invest $450 million in Consensys, Ethereum incubator now valued at $7 billion Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees

Alchemy Integrates Ethereum L2 Product Starknet to Enhance Web3 Scalability at a Price 100x Lower Than L1 Fees Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022

Mining Report: Bitcoin's Electricity Consumption Declines by 25% in Q1 2022 Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million

Oil-to-Bitcoin Mining Firm Crusoe Energy Systems Raised $505 Million Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design

Microbt reveals the latest Bitcoin mining rigs -- Machines produce up to 126 TH/s with custom 5nm chip design Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued

Bitcoin's Mining Difficulty Hits a Lifetime High, With More Than 90% of BTC Supply Issued The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff

The Biggest Movers are Near, EOS, and RUNE during Friday's Selloff Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter

Global Markets Spooked by a Hawkish Fed and Covid, Stocks and Crypto Gain After Musk Buys Twitter Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions

Bitso to offset carbon emissions from the Trading Platform's ERC20, ETH, and BTC Transactions Draftkings Announces 2022 College Hoops NFT Selection for March Madness

Draftkings Announces 2022 College Hoops NFT Selection for March Madness